Part 2 - Intelligent Monitoring Group ($IMB.AX) Deep Dive

Business Operations, Risks, and Scrutiny of Management Track Record

Watch my video on IMG

Read

’s work! It’s incredible :)Monitoring Services

Overview of IMG's monitoring capabilities

Key monitoring products and technologies

Client segments for monitoring services

Intelligent Monitoring Group (IMG) has established itself as a prominent player in Australia's security monitoring industry. The company operates multiple centralized monitoring centers across Australia, serving a diverse range of clients through various subsidiaries and brands. This centralized approach enhances operational efficiency and ensures consistent service quality.

Service Categories

Wholesale Monitoring: IMG provides 'white label' monitoring services to third-party resellers who handle sales, installation, and maintenance.

Direct Monitoring: IMG directly services and invoices customers, including those who have transitioned from wholesaler relationships.

Workforce and Technology IMG directly employs the staff at its monitoring centers, ensuring a unified workforce with consistent training and operational standards. The company leverages cutting-edge technology to enhance its capabilities:

Interactive and Integrated Solutions: Comprehensive security, home automation, and energy management features.

Advanced Communication: Dual-path signaling systems for uninterrupted communication.

Video Surveillance: High-definition cameras with smart functions and video analytics.

Market Position and Subsidiaries IMG's portfolio includes prominent brands such as ADT, Signature Security Group, Monitoring Excellence, Mammoth Security, and Threat Protect. This diverse range of subsidiaries allows IMG to cater to residential, commercial, and government clients across Australia.

Reseller Partnerships Resellers play a crucial role in IMG's business model:

Act as distribution channels and customer interfaces

Enable market expansion without direct sales force investment

Handle sales, installation, and first-line support

IMG provides resellers with training, marketing support, and backend assistance for complex issues.

Subsidiary Roles

IMG's subsidiaries focus on:

Maintenance and servicing of security systems

Installation of new systems

Customer support and relationship management

Business development and sales support

Technology integration and innovation

Customer Base

IMG boasts a well-diversified customer base, with no single client contributing more than 10% of total revenues. This diversity provides a buffer against market fluctuations and reduces vulnerability to client loss.

This streamlined structure maintains IMG's position at the forefront of Australia's security monitoring industry, leveraging economies of scale and advanced technologies to provide comprehensive security solutions across the country.

Protective Services

Range of protective services offered

Key subsidiaries involved in protective services

Notable clients or contracts

Overview

Threat Protect, a key subsidiary of Intelligent Monitoring Group (IMG), has established itself as a versatile and robust security services provider in Australia. The company offers a wide range of services catering to diverse security needs across various sectors.

Core Services

Uniformed Security Officers: Highly trained professionals, often with military or law enforcement backgrounds, serving in static and patrolling roles.

Close Personal Protection (CPP): Specialized service for high-profile individuals, executives, and VIPs.

Security Concierge Services: An innovative blend of traditional security with reception services.

Specialized Offerings

Secure Transport: Safe delivery of valuable items, mitigating risks of theft or injury.

Event Security: Management of large-scale events, including planning, crowd control, and emergency response.

Retail Loss Prevention: Officers combine surveillance with customer interaction to prevent theft.

Mobile Patrols and Alarm Response: Providing both preventive measures and rapid response capabilities.

Consultancy and Investigations Threat Protect extends its services beyond physical security:

Security Consultancy: Risk assessments, security audits, and development of tailored security plans.

Investigations and Counter-Surveillance: Addressing complex security challenges, including fraud and theft investigations and technical surveillance countermeasures.

Notable Clientele and Market Position

Client base spans government and private organizations, focusing on health, local government, and public transport sectors.

High-profile clients include Rottnest Island Authority and the City of Perth.

Primary supplier for major events like Australia Day Skyworks Celebrations in Perth.

This comprehensive approach to security, ranging from basic uniformed services to specialized consultancy and investigations, positions it as a leading security provider in Australia. Its ability to handle diverse security challenges and high-profile clients underscores its expertise and market strength within the IMG portfolio.

Training Services

Types of training programs offered

Target audience for training services

Certifications and accreditations

As a division of Intelligent Monitoring Group, Threat Protect Training has established itself as a comprehensive provider of security and specialized training programs. This innovative approach not only ensures high-quality internal workforce development but also creates an additional revenue stream by offering services externally.

Core Offerings:

Certificate III in Security Operations: A nationally recognized qualification covering defensive tactics, close personal protection, tactical communication, and legal aspects of security operations.

Recognition of Prior Learning (RPL) Program: Allows experienced professionals to have their existing skills formally recognized, potentially reducing time and costs for qualification.

Specialized Training Programs:

Travel Awareness

Terrorism Awareness

Maritime Security Awareness

Personal Safety Training

Healthcare-Focused Training:

Aggressive Behavior Management

Emergency Response (including first aid, CPR, and equipment use)

Key Strengths:

Customization: Ability to develop bespoke programs tailored to specific industry needs and compliance requirements.

Quality Assurance: Registered Training Organization (RTO) status ensures adherence to national standards.

Adaptability: Regular updates to reflect latest security practices and regulatory requirements.

Clientele: Diverse range of government and private organizations across multiple sectors, including health, local government, and public transport.

Threat Protect Training's commitment to industry excellence while monetizing its expertise, positioning it as a versatile partner in organizational security enhancement across various sectors.

Other Services

Additional service offerings not covered in previous sections

Unique or specialized services that set IMG apart

The Services segment of Intelligent Monitoring Group (IMG) is pivotal to the company's business model, encompassing the sale, installation, and maintenance of security equipment. This segment generates revenue through both one-off sales and ongoing contracts.

Product Range:

Cameras: CCTV, IP cameras, and smart cameras with advanced features

Alarms: Intruder alarms, fire alarms, and specialized systems (e.g., panic buttons)

Access Control Systems: Keycard systems, biometric scanners, and intercoms

Innovative Offering: Personal alarm system for elderly care, featuring GPS tracking, fall detection, and two-way communication.

Key Differentiators:

Professional Installation:

Site assessments

Integration with existing systems

User training

Customized solutions for residential, commercial, and industrial applications

Comprehensive Maintenance and Support:

Regular inspections and software updates

Emergency repair services

24/7 support

This comprehensive approach allows IMG to build long-term relationships with clients while ensuring continuous protection and optimal system performance. The combination of cutting-edge products, professional installation, and ongoing support positions IMG as a full-service provider in the security equipment market.

Subsidiaries

Brief overview of each major subsidiary

Specializations and key contributions of each

IMG's subsidiary network provides comprehensive security solutions across various sectors:

Monitored 24/7

Core services: 24/7 professional monitoring, alarm system integration, remote false alarm management, on-site security, and CCTV installation.

ADT Monitoring Services (including ADT Australia)

24/7 monitoring for intrusion, fire, and carbon monoxide

Advanced video surveillance with mobile access

Emergency response and mobile security patrols

Residential and commercial solutions including DIY kits

Signature Security

Comprehensive monitoring with 4G backup

Centralized monitoring for multi-location businesses

Portable safety alarms

Industry-specific customization

ACG Integration and Alarm Assets Group (AAG)

ACG: National coverage, sophisticated security systems (alarms, CCTV, access control)

AAG: High-security solutions, covert investigations, Technical Surveillance Countermeasures (TSCM)

Combined focus on commercial and government sectors

Mammoth Security

Comprehensive product range: IP/analog cameras, access control, intrusion/fire alarms

AI-powered analytics for facial recognition, license plate reading, and behavioral analysis

Installation, maintenance, and support services

Monitored 24 Seven

Integrated security solutions: alarms, fire alerts, access control

Physical security services: on-site guards and patrols

Adherence to Australian Standards

Adeva Security

Customizable residential and commercial security systems

Smart technologies and biometric access control

Emphasis on long-term client relationships through consultation and maintenance

Consolidated Revenue Models

Analysis of revenue streams across all service lines

Recurring vs. one-time revenue breakdown

Key drivers of revenue growth

IMG's revenue streams span across various service lines, with monitoring services leading the way. The company's revenue model balances recurring and one-time income sources, focusing on long-term financial stability and growth.

Monitoring Services (Primary Revenue Driver)

Core: Monthly subscription fees for 24/7 alarm monitoring

Additional: Video surveillance monitoring, emergency response services

Key features:

Long-term contracts (1+ years) ensuring stable, predictable revenue

Scalability through advanced technology and AI-driven analytics

Customizable plans for various customer segments

2024 Performance: $81.6M in sales to external customers or 67% of revenues.

Protective Services (Threat Protect)

Contract-based security services (short and long-term)

High-margin specializations: event security, personal protection, secure transport

Strategic consulting: risk assessments and customized security planning

2024 Performance: $1.6M in sales or 1.3% of revenues.

Other Services

One-off sales: Initial consultations, product sales, installation fees

Maintenance contracts: Steady income stream, fosters long-term relationships

Innovative product sales: Personal alarms with subscription-based services

2024 Performance: $38.6M in sales or 31.6% of revenues.

Key Drivers of Revenue Growth:

Commercial & Enterprise business security:

Goal to return to $130m+ revenue from current ~$40m

Focus on long-term, high-value customers across various industries

Average customer tenure of 10-15 years

Residential security:

Lowering upfront costs for new security systems

Improving monitoring value through video services

Growing market penetration from current <5%

Increasing DIY installations (20% of new customers since June 2024)

ADT Care:

Expanding services to help aging Australians stay in their homes longer

Enhanced customer service and dedicated ADT Care team

Re-signing core partners and achieving NDIS accreditation

Wholesale Monitoring:

Supporting wholesale customers with the latest monitoring services

Assisting industry transitions as competitors look to retire

Significant growth in connected cameras for video monitoring (650% surge in FY24)

Strategic Acquisitions:

Recent acquisitions of ADT, Adeva, Securely (NZ), ACG Integration, and Alarm Assets Group

Potential for further selective M&A to drive growth

Technology and Service Improvements:

Investing in leading technology operating platforms

Focus on video and higher-value services

Leveraging 4 A1 graded security operating centers

Expanded National Coverage:

Growing technician network (96 in Australia, 40 in New Zealand)

Risk Factors

Operational risks

Market and competitive risks

Technological and cybersecurity risks

Regulatory and compliance risks

IMG faces several interconnected risks that warrant careful consideration. At the forefront is the challenge of integrating recent acquisitions. While these acquisitions offer growth potential, they also bring the risk of operational inefficiencies and cultural clashes. The company's ability to smoothly incorporate these new elements into its existing structure will be crucial for realizing the expected results.

Financial risk is another significant concern. IMG's high leverage makes it vulnerable to economic downturns and rising interest rates. However, Peter's presence on the board provides some reassurance. His extensive capital market experience suggests a careful approach to financial decisions, and his reputation might facilitate smoother refinancing processes. That said, if IMG fails to refinance its expensive debt as expected next year, it could signal deeper issues and potentially undermine the investment thesis.

The competitive landscape presents both challenges and opportunities. While the security and monitoring services market is highly competitive, it appears large enough to accommodate major players. IMG's position as a consolidator with access to capital could be advantageous in this environment. As the only publicly listed company of its kind in Australasia, IMG could become an increasingly attractive investment option if it continues to improve its fundamentals.

IMG's growth assumptions for the Australian market represent both an opportunity and a risk. The company's success will depend on effective marketing, competitive pricing, and robust customer service. However, shareholders should be cautious about expectations, recognizing that achieving the same levels of market penetration as in other regions may be more challenging than anticipated.

Management and Governance Concerns: The company's reliance on its experienced management and major stakeholders could be a risk if there are changes in management, strategic missteps, or shifts in investment strategy.

Before addressing potential concerns, let’s first scrutinize Peter Kennan’s track record. Below is a detailed analysis of his previous activist activities and investment philosophy, as outlined in the provided document: Peter Kennan Trackrecord.pdf.

The Cross-Harbour (Holdings) Limited (SEHK:32): Based on my estimates, Kennan began building his position in the company between August 2019 and September 2020, which could imply a drawdown of approximately 36% to 29% if he still holds that investment.

Summary of the Story:

Cross-Harbour (Holdings) Limited is a company with significant investments in tunnel operations, driving schools, and other assets. Major shareholders, including Lanyon Asset Management and Black Crane Capital, raised serious concerns about the company's management, believing that its shares were undervalued due to poor management decisions.

A significant point of contention was the company’s Treasury Management Business (TMB), which had been heavily investing in underperforming small-cap companies. This strategy yielded a meager 1% average annual return over 14 years, starkly underperforming compared to the Hang Seng Index's 8% annual return. Furthermore, the wasteful purchase of a yacht for HK$119 million, which shareholders viewed as adding no value, was also criticized.

At the 2020 Annual General Meeting (AGM), shareholders proposed liquidating the TMB’s assets and the yacht, with the aim of distributing the proceeds as a special dividend of over HK$15 per share. They also pushed for a change in the dividend policy to distribute a larger percentage of annual profits. However, these resolutions, including proposals to replace two directors, were ultimately defeated.

Explanation of the Cross-Harbour Case Study:

In this case, Peter Kennan, representing Black Crane Capital, led the effort against the management of The Cross-Harbour (Holdings) Limited. Kennan and his allies argued that the company’s management was hoarding cash and making poor investment decisions, significantly undercutting the value of the company’s shares. Their strategy focused on urging the company to concentrate on its core businesses—tunnel operations and driving schools—while liquidating non-core assets like the TMB and the yacht to unlock shareholder value through cash distributions.

Despite the well-structured arguments and proposals, the management, led by Chairman Cheung Chung Kiu, resisted these changes, accusing the activist shareholders of prioritizing short-term gains over the company’s long-term stability. As a result, the proposed resolutions were defeated.

Kennan’s approach in this case demonstrated his commitment to enhancing shareholder value by focusing on core business strengths and eliminating wasteful practices. Although he was unsuccessful in this instance, the case underscores his focus on value creation and his willingness to challenge entrenched management practices.

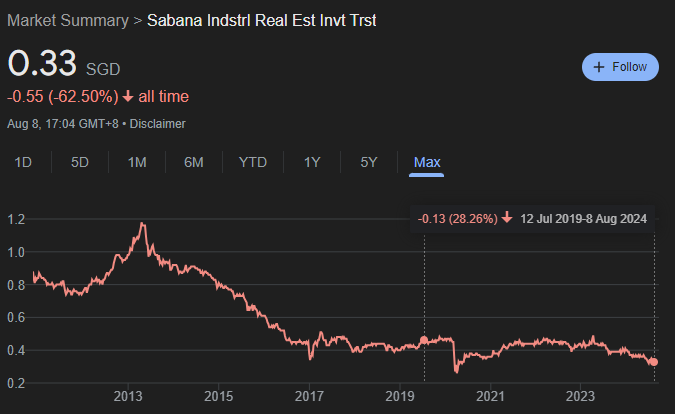

Next, let’s examine the case of Sabana REIT.

According to my guestimates they are down 25%-30% on this investment.

Summary of the Sabana REIT Case Study:

Sabana REIT is a Singapore-based Real Estate Investment Trust (REIT) that has faced significant scrutiny from independent unitholders, notably Quarz Capital Management and Black Crane Capital, led by Jan F. Moermann and Peter Kennan, respectively. The core issue centers on the management practices of the Sabana REIT Manager, particularly the appointment of Mr. Chan Wai Kheong as an independent Non-executive Director.

The controversy began when the board of Sabana REIT Manager appointed Mr. Chan despite potential conflicts of interest stemming from his previous business relationships and substantial stake in a competing entity, ESR Cayman. Quarz Capital and Black Crane Capital argued that Mr. Chan’s appointment should be immediately put to a vote by independent unitholders, in accordance with regulations set by the Monetary Authority of Singapore (MAS).

However, the REIT Manager’s reluctance to hold an Extraordinary General Meeting (EGM) to address this issue raised red flags. Unitholders accused the board of attempting to circumvent MAS regulations and prioritize the interests of the REIT Manager and its shareholders over those of the independent unitholders. There was concern that delaying the EGM could enable the board to continuously appoint directors aligned with their own interests, effectively bypassing the need for independent unitholder approval.

In response, Quartz and Black Crane issued an open letter demanding that the REIT Manager uphold its fiduciary duties and promptly hold the requisitioned EGM. They emphasized the broader implications this issue could have for corporate governance and investor confidence in Singapore’s REIT market.

Explanation of Sabana REIT:

Sabana REIT is a trust that invests in a portfolio of real estate assets, primarily generating income through leasing these properties. Unitholders receive income distributions from the REIT based on the profits generated by these assets. Sabana REIT is listed on the Singapore Exchange (SGX) and focuses on industrial properties in Singapore.

The management of the REIT is handled by a separate entity, the Sabana REIT Manager, which makes decisions on behalf of the REIT, including acquisitions, divestments, and other operational matters. The controversy in this case revolves around the management decisions of this entity, particularly regarding corporate governance practices and the alignment of interests between the REIT Manager, its shareholders, and the independent unitholders who have invested in Sabana REIT.

Given that Quarz still holds its position, it is likely that Black Crane is also still invested and actively working to unlock value. Therefore, it may be too early to assess the outcome of this situation fully.

MMA Offshore Limited (MMA)

Peter Kennan, Chief Investment Officer of the Black Crane Asia Pacific Opportunities Fund, recently resigned from his position as a Non-Executive Director at MMA Offshore Limited (MMA). Kennan had been on MMA’s Board since 2017, joining during a particularly challenging period for the offshore market. During his tenure, he played a pivotal role in helping MMA navigate these difficulties, drawing on his expertise in investment and corporate finance to assist with the company’s capital raisings and debt restructuring efforts. Under his guidance, MMA successfully repaired its balance sheet and diversified its revenue streams.

Kennan’s resignation comes after the Black Crane Fund decided to divest its remaining position in MMA, having met its investment objectives. Despite the divestment, Kennan remains optimistic about MMA’s future, particularly given the recovery in the offshore energy markets and the expansion of offshore wind projects.

Explanation of MMA Offshore

MMA Offshore Limited (MMA) provides marine and subsea services to the offshore energy sector. The company offers a diverse range of services, including vessel operations, marine logistics, and subsea services, catering to both the oil and gas industry as well as the burgeoning offshore wind sector. MMA has faced significant challenges in recent years due to downturns in the offshore energy market but has since transitioned into a more integrated service provider across multiple markets.

MMA was acquired in the recent past, positioning it for continued growth as it leverages its expanded capabilities.

Capital & Regional plc

Summary of the Case Study

Capital & Regional plc is a UK-based property company specializing in the ownership and management of shopping centers, including well-known properties like The Mall in Luton and The Mall in Maidstone. The company also owns Snozone, the UK's largest indoor ski slope operator. Founded in 1979, Capital & Regional faced significant challenges during the COVID-19 pandemic, with its share price plummeting nearly 80% in 2020. This sharp decline was driven by negative investor sentiment towards retail properties, exacerbated by the pandemic's severe impact on the retail sector.

In response to these challenges, Black Crane Asia Pacific Opportunities Fund, a Hong Kong-based activist investor, gradually acquired a 4.2% stake in Capital & Regional in 2020, becoming the third-largest shareholder. Black Crane specializes in undervalued companies, aiming to influence corporate governance and drive strategic changes over a multi-year investment horizon. Despite the tough environment, Capital & Regional's rent collection remained relatively strong, supported by its exposure to essential retailers and click-and-collect services that continued to operate during lockdowns.

By mid-2020, the company’s financial situation was strained, with a 16% drop in portfolio valuation and significant net debt. However, the acquisition of a controlling stake by South Africa's Growthpoint Properties in 2019 provided some relief, temporarily lowering the loan-to-value ratio and offering financial stability during the crisis.

Explanation of Capital & Regional plc

Capital & Regional plc is a specialist property company with a focus on owning and managing retail properties, particularly shopping centers in the UK. Its portfolio includes several prominent shopping centers, along with Snozone, an indoor ski business. The company’s primary revenue stream comes from rental income generated by these properties.

The COVID-19 pandemic posed significant financial challenges for Capital & Regional due to the downturn in the retail property market. However, its resilience in rent collection and strategic investments from shareholders like Growthpoint Properties and Black Crane Asia Pacific Opportunities Fund provided much-needed stability during these turbulent times.

This case study highlights the pandemic's impact on the retail property sector and demonstrates how activist investors like Black Crane identify potential in distressed assets, seeking to unlock value through strategic involvement and long-term investment approaches.

Elders Hybrid Securities

Case Study: Black Crane Investment Management’s Investment in Elders Hybrid Securities

Black Crane Investment Management specializes in deep value investing, targeting companies that face significant market pessimism due to temporary setbacks. A notable example of this approach is their investment in the hybrid securities of Elders, a company that faced severe challenges, including prolonged drought conditions and the failed sale of its core business. These issues led to a sharp decline in the price of Elders' hybrids, dropping from approximately $30 to a low of $8.50.

Instead of retreating, Black Crane, driven by thorough research and strong conviction, viewed these challenges as temporary rather than permanent. They increased their investment, reducing their average entry price to $22 and ultimately growing their stake in the hybrids to 30%. This strategy paid off as Elders’ situation improved—weather conditions normalized, management reduced overheads, and the business regained stability. Eventually, Elders repurchased all the hybrid securities at $95, enabling Black Crane to achieve a significant return on investment, transforming an initial 8% loss into a 44% positive contribution to their fund’s NAV.

This case exemplifies Black Crane’s deep value investing strategy, characterized by a highly concentrated portfolio, rigorous research, and a willingness to endure short-term losses for long-term gains. It underscores the importance of emotional resilience and the ability to capitalize on market overreactions to temporary setbacks.

Conclusion

Based on my rough estimations and other, more reliable analyses, the batting average from this small sample of case studies appears to be 3 out of 5, or 60%. While this isn’t a bad outcome, I acknowledge that my estimates could be significantly off, either underestimating or overestimating Peter Kennan’s abilities.

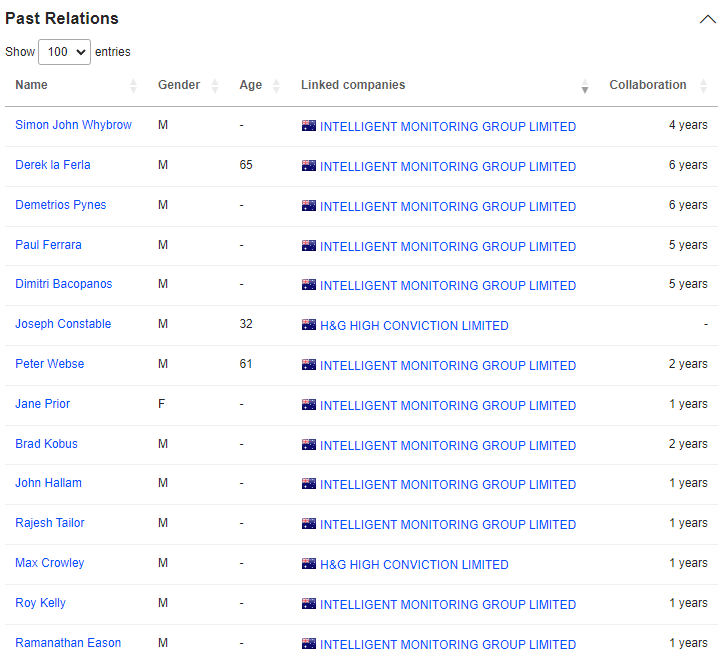

Regardless, the anecdotal evidence I’ve gathered suggests that the management team at IMG is competent and has a history of working together in other ventures. For instance, Peter Kennan seems to have previous connections with some of the key individuals at IMG:

This indicates that either Peter or Dennison, or both, have built a team they trust and know well.

I doubt there’s any incentive for them to act dishonestly. However, if Dennison were to leave, I believe IMG’s future could still be promising, as Peter would remain aligned with shareholders and likely find a suitable internal replacement. On the other hand, if Peter decides to sell, it could be a red flag, especially if it follows a negative announcement. That said, selling is part of his strategy, so it’s expected at some point.

In summary, major stakeholders are almost certain to exit over the long term. The key is to analyze the reasons behind their exit. Management is a critical pillar of the investment thesis, and while this risk can’t be fully mitigated, one approach could be to build a position incrementally. By observing management’s actions over time, shareholders can better assess their long-term intentions. If the right levers are pulled, shareholders can increase their investment accordingly.

Dennison

Peter