H1 25 – First Time Sharing Performance

The first half of 2025 in review.

Intro

A lot has changed since my last update. From now on, I’ll be sharing my investment results twice a year. I’m doing this for a few reasons: I’ve launched a new micro-cap related project and want to be transparent and accountable, you can check it out at Value Bridge; I finally have a clear investment strategy after years of experimenting; and, even if it’s hard to admit, this is the first time I’m proud of my recent results, even if six months isn’t enough to prove anything long-term. Plus, I’ve finally started tracking my performance properly, which I should have done from the start.

I still have a small part of my portfolio in an old family account (from when I was a minor), but I’m moving everything into my own name for simplicity.

In short, I’m doubling down on micro-caps, not out of some quirky love for tiny companies, but because I believe that’s where I have the best shot at outstanding returns with small amounts of capital. I won’t rehash the usual micro-cap arguments, but let’s just say early Buffett and Munger were big influences on my approach as well as

, , and (he’s tool, Tracktackle, has helped me a lot in the past 6 months as a beta tester, I’m not endorsed but feel free to check it out)Humility

Before sharing my performance and talking about what I have bought and sold in H1, I would like to share some thoughts I’ve been having on humility.

A lot of people ask me what are these FTD posts I do every week. I call it Fool Things Done, I got it from a book a couple of years ago. The whole goal is to practice humility, I don’t think it has made a great deal of difference, but I’ll keep at it.

First, as with most loaded concepts and words, I’ll break down what humility means to me with a simple formula, feel free to disagree.

Humility = Self-awareness + Openness to learning − EgoIt’s funny how closely humility and ego can mirror the booms and busts of the stock market. At least in my experience, the universe always finds a way to keep my humility in check when my ego drifts a bit too high. I have to admit, I’m very susceptible to overconfidence, not necessarily in my investment ideas, but in my day-to-day life.

With that said, I’ve made multiple dumb and avoidable mistakes in these first six months of the year, both in investing and on a personal level, some of which might have very real consequences. But as Warren once said in a Berkshire meeting, one should rub one’s nose in one’s mistakes, but not so much as to dwell and waste time with regret or self-pity. Mistakes are a major part of life, whether we like it or not, and if we need to cry a bit or punch a punching bag in the gym to cope with our stupidity, then so be it. But once that’s done, the best way to proceed is to learn what the mistake has to teach us and gracefully move on. As far as I’m concerned, that’s the greatest sign of intelligence as defined below.

Intelligence = Same Condition * New BehaviourI have to thank my “friend” Hormozi for this one…

Like most things, this is easier said than done. Humility is a constant balancing act that I’m still trying to figure out. I think a big part of it is accepting that we don’t have all the answers in life.

Portfolio Review

As of 30 June, my portfolio did 32.05% (TWR) vs 5.5% for the S&P 500 Stock Index.

Now Vertical Group ($NOW.V)

Position Size: 19.4%

NowVertical was the biggest contributor to H1’s performance (+10.28%), which is also why it’s my largest position today.

Sandeep and the whole team at NOW continue to deliver on their optimistic outlook in a consistent way. Usually, over-optimistic talk leads to disappointment, but so far, things are moving in the right direction, especially with the new $26 Million USD in Financing with HSBC. This should provide plenty of room to cover the convertible loan and support both organic growth and acquisitions. Of course, there are risks with any turnaround and small company, but NOW really has the potential to become a growth story, not just a deep value play like it was 6–8 months ago.

I’ve also had the pleasure of speaking with Sandeep fairly often over the past few months, and I’m very impressed by his energy and integrity. For reference, you can check out my interview with him here.

ValueHunt is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Asseco Poland ($ACP.WA)

Position Size: 16.7%

It was truly an honor to contribute, even in a small way, to this great write-up posted by my friend and mentor

Christian Schmidt

. That said, Asseco really is the ultimate “low IQ bet-on-the-jockey” case, so I won’t take up much of your time here. Following Constellation Software and Pinetree Capital in their public investment has been a great source of alpha, what a fancy word…

We’re still waiting for regulatory approval, which I see as the next big event. I reached out to Asseco’s IR and was granted a call, but they kept postponing it and eventually did a group call with dozens of investors, which I couldn’t attend. Honestly, I don’t feel like I missed much since there isn’t much they could have said that would truly change the thesis. The stock is up more than 55% since I first bought shares, and 43% on my full position.

Lindbergh SPA ($LDB.MI)

Position Size: 13%

This one isn’t the cheapest name in the portfolio. According to my estimates, Linbergh should be trading at 7.5-8.5 times FY25 EBITDA, very roughly speaking, or 11-12x EBIT. But I’m very comfortable with it as they should be able to add at least €1M/year in EBITDA with HVAC, and I basically see it as a private equity platform going forward, a la Brent Beshore (if you haven’t watched this interview already, what are you doing?). BuildDirect, a similar case, which btw I interviewed the CEO here, trades at more than 20x EBITDA, with a much lower margin and return profile.

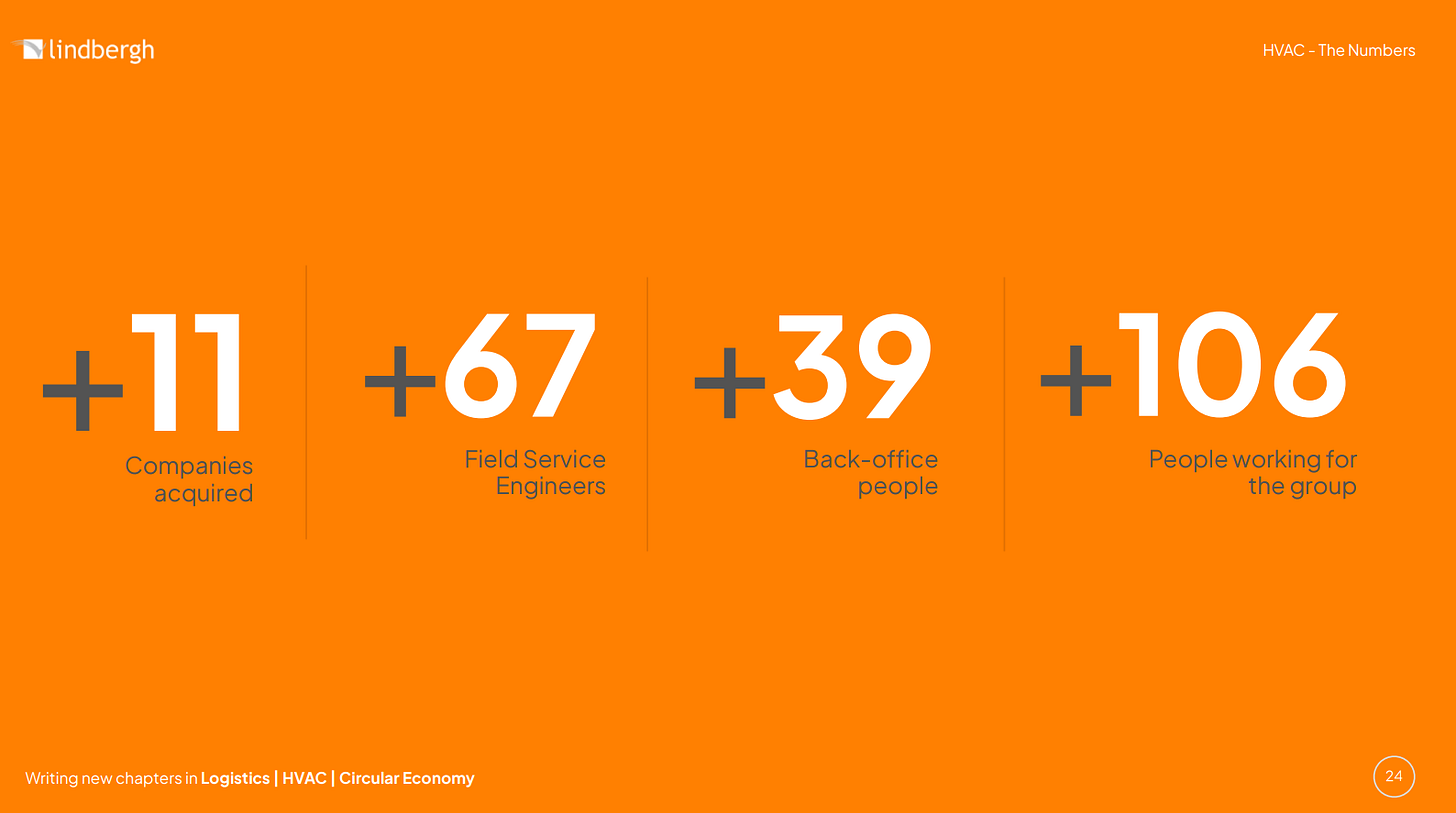

They have done 11 acquisitions already as of May, and Michele, the CEO, strikes me as an opportunistic and intelligent CEO who knows how to delegate. Additionally, one of their biggest assets is having Sun Mountain as a big shareholder. I can tell their capital allocation has improved tremendously, and I honestly doubt they would have embraced this serial acquirer model as fast as they’ve done without Chris Solberg and William Thorndike, who manage SMP. Shareholder communication and other reporting details have also improved since SMP started a position.

If you aren’t aware of how they are approaching acquisitions, their Redeye Serial Acquirers 2025 Conference presentation is a must-watch.

Intelligent Monitoring Group ($IMB.AX)

Position Size: 10.7%

I’ll admit, I had a bit of a crisis of faith with this one. It’s still one of my biggest positions, probably the biggest at cost, and right now, I’m basically breaking even. I had the chance to interview Dennison, and he came across as very straightforward and competent. He’s definitely aware that they made a big communication mistake. Maybe it’s wishful thinking, but I’m hoping for a good H2…

McCoy Global ($MCB.TO)

Position Size: 10.3%

Since the bull case has been fairly distributed among the micro-cap community, I’d like to try to point out some of the risks related to McCoy.

I decided to start from the past, so what happened during 2006-2009 for the stock to drop almost 90%?

Well, during 2006-2008, McCoy benefited from high oil prices and a booming drilling market. The company grew aggressively through acquisitions, particularly in tubular make-up equipment and services. However, when the Global Financial Crisis hit in late 2008, oil prices collapsed, leading to massive rig count reductions globally. This directly impacted demand for McCoy's equipment and services, which were tied closely to drilling and completions. At that time, McCoy was heavily exposed to the North American market. The shale boom hadn't fully matured yet, and their international diversification was weak, amplifying the damage from the downturn. The aggressive expansion before the crisis (through acquisitions) also meant high fixed costs and integration risks. When revenue dropped in 2009, operating leverage worked sharply against them, causing significant earnings deterioration.

What about post-2014, and their 95% decline?

The collapse in oil prices from over $100 per barrel in 2014 to under $30 in early 2016 caused a severe downturn in drilling activity worldwide, particularly in North America, where McCoy had the highest exposure. This crushed demand for their tubular make-up equipment. McCoy’s core products were capital equipment tied to rig utilization. As operators shifted toward more automation and efficiency, demand for McCoy’s older product lines softened. The company was late in pivoting to software-enabled and service-oriented solutions. Like in 2009, the drop in revenue didn’t come with a proportional drop in costs. The operational leverage worked negatively, driving profitability into negative or near-zero territory. After 2014, there was a major trend towards automated tubular running services, with competitors like Weatherford and NOV offering more comprehensive digital solutions. McCoy was behind this curve until very recently, when they started rolling out their smarTR™ system. The gap from 2014 through the early 2020s led to significant market share erosion. The shale revolution changed how drilling programs were executed. Instead of many smaller jobs requiring equipment mobilization (good for McCoy’s rental and service revenue), the industry consolidated into larger pad drilling operations with less frequent equipment changeovers.

Revenues collapsed by more than 65% from 2014 to 15.

What does this mean for the future?

There’s a case to be made that MCB is now better prepared to weather downturns in the market thanks to their SaaS-type product and the fact that smartTR products save money for their clients. However, I believe it would be overly optimistic to say they wouldn’t be affected by low oil prices. So far, they have shown they can grow both top line and bottom line really fast despite a rather soft market, but a down market would definitely hurt McCoy, in my opinion.

Other than broad market drawdowns and macro events, I can’t really see any other massive risks. At an 8x EV/FCF multiple, we’re getting a fast-growing, expanding-margin, high-return business with unique IP. This is about as close as you can get to a competitive advantage in the micro-cap space. Plus, as the discovery cycle plays out, I believe more institutions might start to pay attention, which could in turn activate a second engine for outstanding returns, multiple expansion, getting closer to historical highs of 20x EBITDA (it currently trades at 7x).

Evolution AB ($EVO.ST)

Position Size: 9.9%

Wow, EVO was by far my largest position at the end of 2024. After Q4, I cut it by more than half, then bought back some recently, which ended up saving me from a 20% drop on most of my shares. If it weren’t for that lucky trade, maybe my results would look very different today. I decided to rebuild my position because I see positive signs from the CEO that things are starting to turn around, and honestly, at 8x EBIT, I’m willing to take the bet again.

EVO taught me a lot, mainly that catalysts and timing really matter, and a good idea can be dead money for a long time. Sometimes it’s wiser to wait for a clear signal before making a big move, rather than catching a falling knife. I’m not pretending I can time stocks, but sometimes spotting a catalyst isn’t that hard, especially when management doesn’t have a habit of overpromising.

“A focus area in 2025 is to make a shift in the resource mix with the aim of allocating more to cost-effective studios. Carlesund also pointed out that ‘2025 will be a good year.’ A slightly tougher start, but there is good momentum into Q2 and he is looking forward to 2025.” – Source

CTT ($CTT.LS)

Position Size: 6.9%

It’s very likely that if I find something better, CTT will be the name in the portfolio that will have to go. Depending on how you value it, there might still be big upside on this one, but things have to go right for that to happen. I have it at around 12x EV/FCF. I’ll stay put for now, maybe wait for a couple more quarters and see how this goes

Teqnion ($TEQ.ST)

Position Size: 6.6%

Teqnion is a legacy position and certainly the most expensive name in the portfolio, trading at 12–14x FY25 EBITDA. I believe there’s a sentiment-shift opportunity here, as some people are even calling it a fraud. It went from being a Twitter darling to one of the most hated companies. Hot take: people are just mad because they got burned on it.

There was some turmoil on X around Daniel’s girlfriend being the CEO of Eloflex, litigation over some earnout payments, and controversy about the new compensation scheme. Here’s my two cents on all that.

The compensation is basically like a performance fee, they get a percentage of the market cap with a hurdle. I think this is very innovative and definitely aligns them with investors. It could be risky and incentivize wrongdoing, but I believe that risk is fairly mitigated by their sizeable stake in the company and, more importantly, by Chris Mayer’s seat on the board. I mean, if he thought this wasn’t good for shareholders, I doubt he’d let it pass.

Regarding the earnout to Reward Catering, Kevin Ward (the former CEO involved) has a history of legal issues in Ireland, including cases related to fake alcohol and pandemic-related medical distribution problems. So, he doesn’t have the best reputation. I believe Teqnion’s management is acting in shareholders’ best interest by pushing out the earnout. The real problem here seems to be that Daniel’s due diligence wasn’t thorough enough.

As for the girlfriend situation, it appears Daniel wasn’t involved in the hiring process for obvious reasons, and the board was fully aware of this. Plus, Eloflex is performing much better under her leadership, so I think this issue has been overblown. Teqnion never issues press releases on subsidiary CEO appointments. Linnea’s salary is in the lowest 10% of all CEOs and the absolute lowest relative to company size.

To sum up, I’m in “show me” mode, just like with IMG. Maybe I’m learning that I shouldn’t always give management teams the benefit of the doubt, but I’m willing to trust my initial research on their integrity and see where this goes. As I said, Teqnion isn’t exactly cheap, but if they deliver on what seems like an imminent turnaround, this could still bring a very decent short-term return.

Valaris ($VAL)

Position Size: 4.7%

VAL is the only speculative bet in my portfolio, and so far it’s been a negative contributor. It’s still incredibly cheap unless there’s a brutal hit to oil prices, something I have no pretension of predicting. But I believe the potential reward is high enough to justify taking this bet. Plus, offshore drilling is such a fascinating industry to study.

Undisclosed Position

Position Size: 1.8%

Positions Sold

REV Group ($REVG)

Sold due to opportunity cost, the thesis has materialized quite well, margins expanded, and multiple too, I need to start looking well into the future to make it cheap. I will be looking at their earnings closely, though, so I haven’t completely discarded it as an investment.

Dino Polska

I sold Dino mainly because of opportunity cost and reinvested most of the proceeds into McCoy and EVO, which I believe have better return potential going forward. I also think the recent run-up in Dino’s stock price isn’t backed by fundamentals, which was disappointing. Still, Dino was a big contributor to my performance.

Autocount Dotcom ($ADB)

I got very lucky here. I did minimal research and sold right before a 30% crash, again due to opportunity cost. It wasn’t a big position, so it didn’t move the needle much, but that bit of luck helped offset losses from other trades, like AFL.AX, which I sold quickly at a loss since I don’t see a catalyst right now. I interviewed the CEO of AFL here. Despite the luck and good timing, ADB’s contribution to the YTD results was almost less that 1% as it was a small position.

Lifco ($LIFCO-B)

Same reason as Dino, I sold due to opportunity cost. Lifco was a much smaller position, and since I couldn’t really add more (the valuation already priced in perfection), I decided to free up capital for other opportunities.

VUAA

I wrote about this on January 27th, before the April market turmoil, and it turned out to be a very lucky decision.

“Sold for a couple of reasons, 1) This was a legacy position, I used to dollar cost average into this ETF, but as the market has kept performing the way it has, my opportunity set looks more attractive, and cash position is running low, I decided to liquidate the position realizing a lot of gains, I don't feel like I'm any good at predicting what the market will do, what I do know is that I have better opportunities, and if for any reason the market crashes I won't have the capital to average down because I'm basically fully invested, which could result in an impairment of capital for an extended period of time. Also, I'm quite positive that this is only the start of my learning curve, but I am also conscious that at some point I'll have to make the decision of whether I'm good at this game or I would rather be a passive investor, therefore my story with ETF's might change in the next decade.”

What Have I Learned? (Best Mistakes)

You don’t have to make your money back the same way you lost it?

Don’t try to be right, try to make money.

Generally, you have much more time than you think to enter a position

I’m a bad intuitive thinker

I can make very stupid decisions if I’m scared, stressed, or distracted.

Conclusion

I’m 19 and have so much more to learn about analyzing businesses, my apprenticeship with

has certainly been a humbling and enriching experience, and I attribute these better than average results in part to him.If I had to sum up his teaching in a few sentences, I’d say:

Catalyst matters a lot, having a high hurdle pays off, reading press releases pays off, and reading investing books becomes kind of useless after a certain point. DCFs are BS, multi-year forecasts are BS, try to figure out this year’s or next year’s earnings, and work with that. If you need to estimate 10 years out to make something look cheap, maybe it should go into the “too hard” pile. Timing matters. You can “trade” profitably, since I know this will be controversial, I’ll expand on it: I don’t mean trading on technicals, but for example, I digested REVG’s news before most people and bought shares pre-market, which turned out to be a great trade. That’s what I’m talking about. Also, I need to sharpen my accounting skills.

The ultimate lesson is that you must be humble, and it’s important to test things out for yourself to see what truly works. This is tricky because two people using the same strategy in different market environments might draw different lessons. But over a long enough period, you can truly understand what makes intrinsic sense to you and adjust when needed. For example, Christian used to be extremely concentrated; now he’s more diversified, and it looks like that hasn’t hurt his returns.

My goal for this summer is to start generating more independent ideas and get into MicroCap Club. Even though listening to way smarter people has paid off, I believe the only way to become a great investor over time is to do the heavy lifting yourself. There’s nothing wrong with sharing ideas and having a good network of smarter investors, but I really want to contribute to this network, not just extract info, which, by and large, is what I’ve been doing.

Thanks for reading!

David Barbato

Good luck with getting into the MCC :) Looking forward to your own investing ideas and the next few years to come :)

Thank you and good luck!!