Global Crossing Airlines ($JETMF) - America's fastest growing and profitable charter airline.

Best in class returns on capital, and margins, what about the upside?

Ticker: JETMF (OTC)

Price: USD $0.58

Shares Outstanding: 61.16 million

Fully diluted: 88.9 million

Implied Market Cap: USD $51.56 million

Net Debt: USD 74.8 million (as of March 31, 2025)

Enterprise Value: USD $126.36 million

Legal Disclaimer: Not Financial Advice

The information provided in this interview and write-up is for informational and educational purposes only and should not be considered legal, financial, or investment advice. I am not a financial advisor and nothing discussed should be interpreted as a recommendation to buy, sell, or hold any financial asset or security.

Additionally, I do not promote any stocks, investment opportunities, or financial products. I have not received any compensation, payment, or incentive—financial or otherwise—for participating in this interview or doing this write-up.

Always conduct your own research and consult with a qualified professional before making any financial or investment decisions.

Interview

The Company

Before immediately passing on this one because it’s on the airline business I stopped a minute to dive deeper and understand how this one is making a profit despite its small airline status and the industry’s reputation of destroying capital.

What caught my interest was that the CFO, one of the founders, walked the talk.

“If someone tells you about EBTIDA through it out, EBITDAR is probably worse, we want to develop sustainable net income” - Ryan Goepel, the President, and Chief Financial Officer

Global Crossing Airlines Group (JET) is North America's fastest-growing charter airline, specializing in outsourced passenger and cargo air services primarily through ACMI (Aircraft, Crew, Maintenance, and Insurance) and charter operations. Unlike typical scheduled airlines that sell individual tickets and operate fixed routes, JET operates on a block-hour billing model where customers pay for the time the aircraft is in use, providing flexible, on-demand air transport solutions.

The company earns most of its revenue from these flights, handling about 75% of ICE’s flight volume. In 2024, Global Crossing made $223 million USD in revenue, mostly from ICE contracts.

ICE does not operate its own flights but hires contractors. A new five-year contract worth about $300 million was awarded to CSI Aviation, which subcontracts the flights to operators like Global Crossing. Another company, Classic Air Charter (CAC), has sued ICE, claiming the contract was improperly awarded and that CSI is being overpaid.

The contract pays based on flight volume, not on the number of deportations or passengers, so Global Crossing gets paid even if planes fly empty.

Currently, flights are running under a temporary contract while the lawsuit is ongoing. The government has 60 days to respond, and the outcome will affect Global Crossing’s future.

Global Crossing recently received approval to expand its fleet to 20 aircraft and is planning to start widebody charter operations, but it remains heavily dependent on ICE contracts.

This model shifts fuel and operational cost risks to the customer in many cases, allowing JET to focus on operational efficiency and reliability. JET serves government agencies, sports teams, travel operators, and logistics companies, emphasizing high on-time performance and fleet utilization, with a growing fleet and expanding market presence in both passenger and cargo charter markets.

The Financials

The decline of charter revenue is a premeditated move to focus more on higher-margin business in ACMI (see note 1).

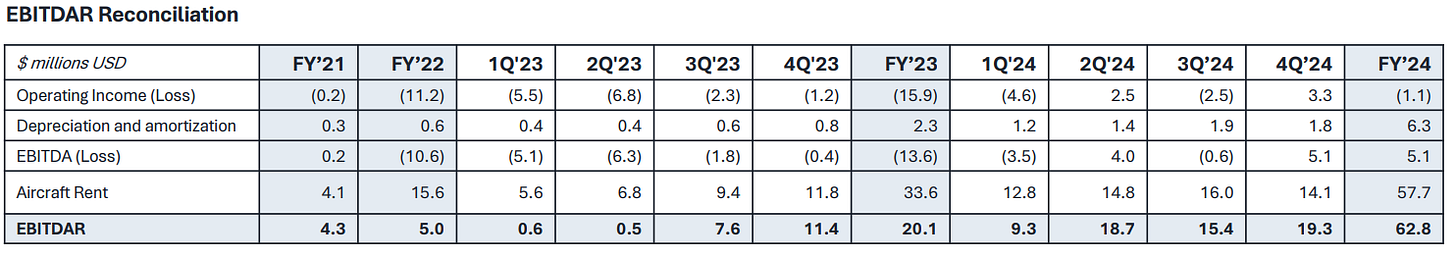

For JET the best measure of underlying profitability is Operating Income, though EBITDAR is way better for valuing it so one evens out the effect of leasing the aircraft vs buying them when comparing them to competition so that’s what I’ll use for my valuation.

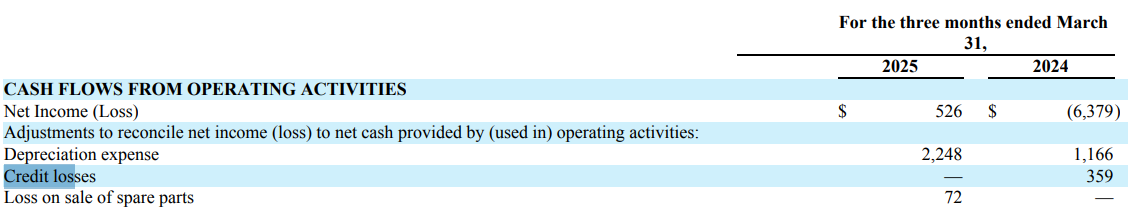

Anyhow, we can see that FY24 has been a transformational year for JET, Operating Loss improved significantly from -$15.9M to -$1.1M for the full year with Q2 and Q4 showing positive EBIT. Operating income for Q1 25 was a positive $3.1M vs -$4.6M in Q1 24. This is even more impressive due to the typical seasonality of the business, Q1 and Q4 tend to be the worst quarters for an airline such as GlobalX and they were able to post 2 consecutive quarters of positive EBIT.

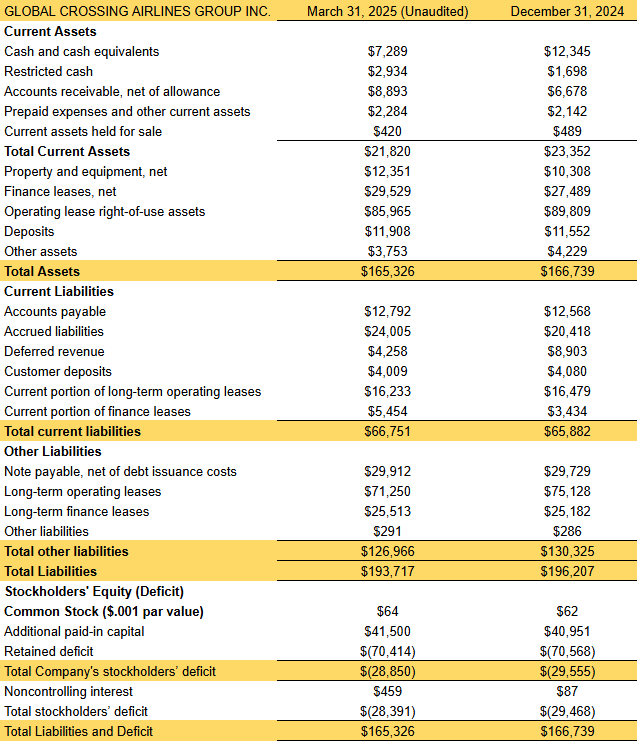

The balance sheet reflects an asset-light business model heavily dependent on leased aircraft (evident from the $86.0M in operating lease right-of-use assets), which is typical for modern airlines focusing on operational flexibility rather than asset ownership. This might change in the future as management has left the door open to acquire aircraft in the future therefore increasing EBITDA but reducing the returns on capital.

The reduction in cash on hand seems to be mostly attributable to the due course of business and investments for growth.

I would love to see them reduce their debt levels as they generate cash as every dollar of debt paydown should be accreditive to the stock performance at constant EV/EBITDAR multiples. Their current ratio (0.33 as of Q25) is well above what I would typically like to see, but given the turbocharged growth they’ve had it looks like they have been pretty opportunistic in taking on debt.

The rest of the balance sheet is pretty standard for a business model like JET’s but happy to answer any specific questions on this side.

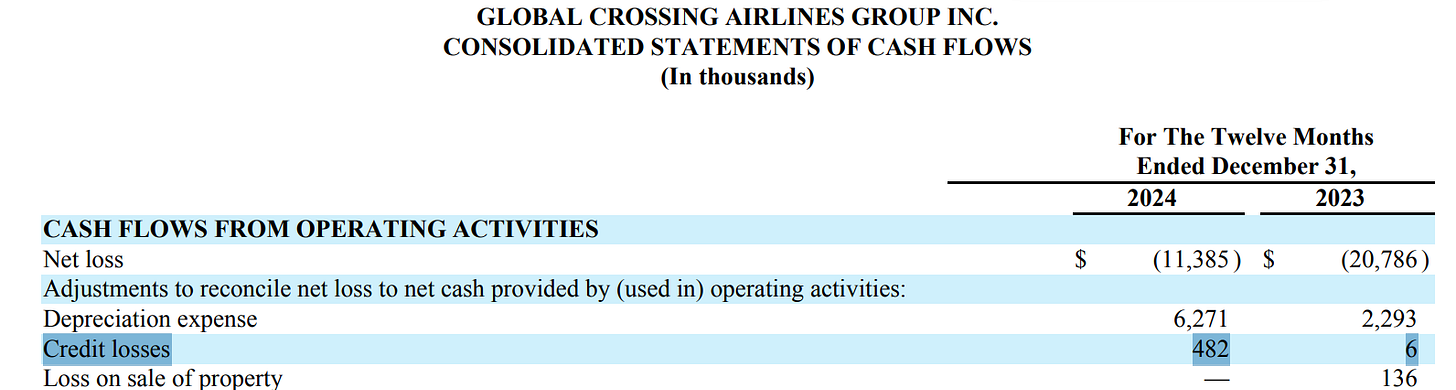

The increase in bad debt allowance in 2024 appears to have been a one-time adjustment to credit risk, possibly related to specific customer issues or the aircraft lessor settlement, rather than a systemic problem. The company's shift toward ACMI business and recent quarters showing no additional credit losses suggest they've taken steps to better manage credit risk going forward.

One thing that immediately captured my attention is their huge customer concentration, more on this in the risk section of this write-up. Despite the improvement in relation to Q4 24 customer concentration in the biggest 2 customers remains at 43%.

“The Company has 2 customers that accounted for approximately 36% and 7% of the revenue for the three months period ended on March 31, 2025, and approximately 26% and 14% of the revenue for the three months period ended on March 31, 2024. The Company expects to maintain these relationships with those customers.” - link

Risks

Customer concentration

As previously mentioned customer concentration is a big concern here. This is pure speculation and devil advocate type thinking, but supposing that the US government is the biggest customer standing at 37%-40% of revenues and given that they have been a beneficiary of the ICE Air Flights which basically deports criminals arrested in the USA to their home countries, if policy changes in this respect in the future, all of a sudden they might lose a big part of their revenues, most of the growth could be attributable to the ICE programs. Since I couldn’t find any information prior to FY24 on customer concentration I believe it’s a fair assumption to assume this is mainly a recent trend.

Opaqueness in the Anonymous situation

There have been recent reports of cyber attacks from the activist group of hackers, Anonymous, neither the company nor the US government have decided to comment on this situation, and there are no manifests from the group other than this X (Twitter) post. I regard this as a one-off but if the company gets targeted by activist groups this might be negative publicity for their brand and result in loss of business in the future, the company issued a press release explaining the situation.

Valuation

First and foremost I should say I’m not trying to be the most accurate in modeling JET’s financials, Ian Macqueen from Bancroft Capital, does a far better job at that.

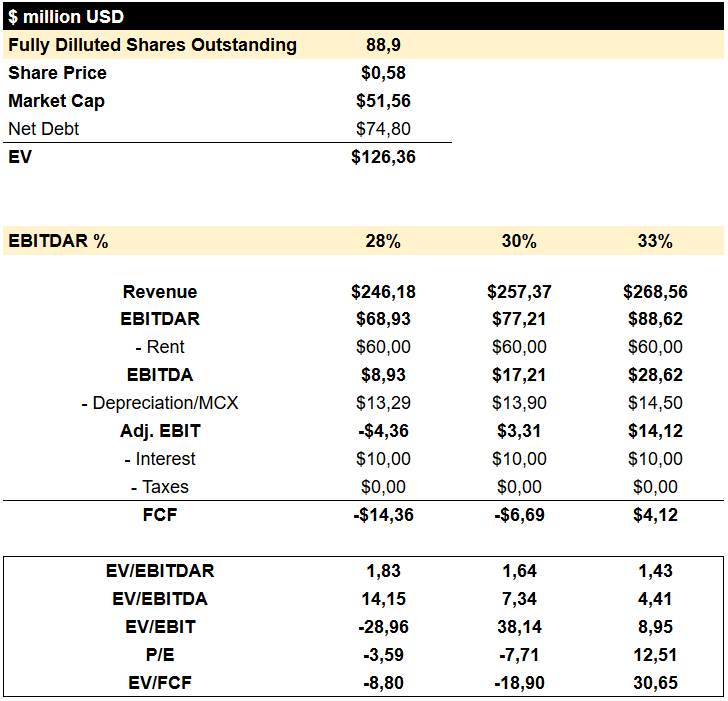

What I’m attempting to do is get a sense of what type of multiples we’re looking at with fairly conservative assumptions.

For all my estimates I assumed a 21-aircraft fleet and used historical averages for figures such as rent and MCX (maintenance capex).

But all this information is of little value unless we have a sense of the multiples at which their competitors trade. Ryan told us in the interview that most peers trade in the 4x-6x EV/EBITDAR range, which would imply at least a double from current levels of LTM EV/EBITDAR of 1.7x. Still, it’s worth noting that only in the best case will we see positive owner earnings, but that is easier and harder at the same time to achieve than it looks like, due to operating leverage, which works as a double-edged sword. Basically they’ve got to a size where most of the incremental aircraft’s revenue per blocked hour will go down to the bottom line, but at the same time if they fail to get a high utilization rate on their fast-growing aircraft fleet this might backfire.

Conclusion

Overall this is not a simple case at all and for that reason, I’ve decided to put this into the too-hard pile for now, but it will definitely stay on my watchlist as this might become a no-brainer in a short period of time, and as they start buying aircrafts vs leasing them they can get $3M-$4M in incremental EBITDA per aircraft which, assuming stable prices, will make JET even cheaper than what it is today on an EBITDA basis, but will surely decrease their ROCE which is best in class at the moment. Also thanks to my mentor

I’ve been focusing more and more on catalysts that might unlock value upfront, and I haven’t been able to convince myself that this story has one yet.On a side note, you can monitor in real-time the activity of their fleet using this website.

NOTES

1

You describe ICE Air as flying criminals back to their home countries but non-nationals are being flown to CECOT in El Salvador and Guantanamo Bay in Cuba without trials. A 60 Minutes investigation couldn’t find any previous criminal record for 75% of CECOT deportees.

Hi David

One quick question: could you briefly outline how you got to the net debt figure? I assume you dealt with leases in a particular way and I would like to learn how you approached it.

Thanks in advance!