Disclosure: EVO is my largest position, so take my views with a grain of salt. That said, I’ll do my best to stay rational and objective.

From a financial perspective, EVO’s growth this quarter wasn’t exceptional, and I believe the adjusted figures provide a clearer picture of its operating performance. However, considering the broader challenges, cyberattacks in Asia, strikes in Georgia, tax rate doubling, negative FX impact, major upfront investments in LATAM and the Philippines to open new studios, and increasing regulatory pressure, these results demonstrate what EVO can achieve even in a tough year. Not many companies can grow revenue by 12% and EBITDA by 8% under such conditions. Of course, if these issues persist, the outlook changes, but I sense that most of these are short-term disruptions.

I’m also pleased with the dividend and share repurchase program. With a shareholder yield of 7.4%, the stock is trading at attractive levels. If they buy back shares aggressively at these prices, it would be highly accretive for long-term shareholders.

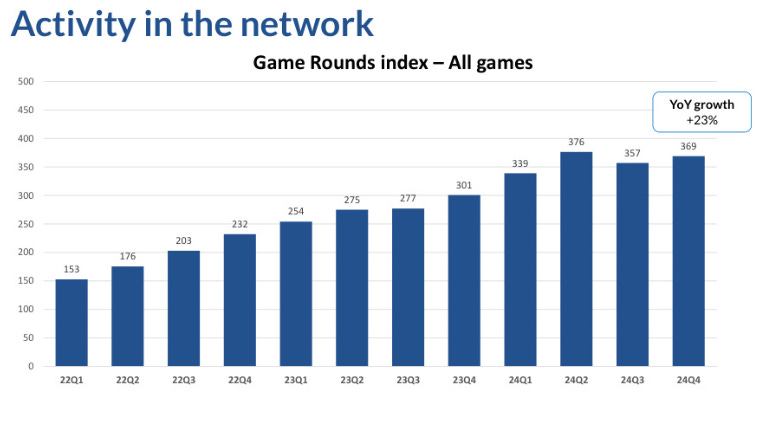

Speaking of the long term, it’s interesting to see the CEO focusing more on game creation rather than just the numbers. Many shareholders treat the stock as a trade rather than an investment, overlooking that the quality of EVO’s games and player engagement are the best long-term performance indicators. As their Q4 presentation shows, their game rounds index increased by 23% yoy, reinforcing this perspective.

With no debt on the balance sheet, the long-term risks come down to management’s integrity, execution, and unforeseen challenges, the biggest risk in any investment.

Overall, I’m optimistic that long-term shareholders will be rewarded. As the business continues to execute and moves past these short-term challenges, the narrative could look very different.

Financial Performance Overview

Q4 2024:

Total Operating Revenues: Increased by 31.5% to EUR 625.3 million.

Net Revenues: Increased by 12.3% to EUR 533.8 million.

Live Growth: +13.3% to EUR 459.5 million.

RNG Growth: +6.7% to EUR 74.4 million.

EBITDA: Increased by 35.0% to EUR 455.0 million, with a margin of 72.8%.

Adjusted EBITDA: Increased by 7.9% to EUR 363.6 million, with a margin of 68.1%.

Full Year 2024:

Total Operating Revenues: Increased by 23.1% to EUR 2,214.1 million.

Net Revenues: Increased by 14.7% to EUR 2,063.1 million.

Live Growth: +16.6% to EUR 1,775.7 million.

RNG Growth: +4.4% to EUR 287.4 million.

EBITDA: Increased by 23.2% to EUR 1,561.8 million, maintaining a margin of 70.5%.

Adjusted EBITDA: Increased by 11.3% to EUR 1,410.7 million, with a margin of 68.4%.

Key Highlights

Dividend and Share Repurchase: The Board proposes a dividend of EUR 2.80 per share and plans to repurchase shares up to EUR 500 million.

Live Casino Growth: Over 1,700 Live tables by the end of 2024, a net increase of about 100 tables during the year.

Regional Performance: Strong momentum in North America, Latin America, and Europe. Asia faced challenges due to cyber-attacks, resulting in flat development.

Regulatory Landscape: Shifting regulatory environment with increased focus on compliance and market adaptation.

IP Protection: Initiated more focused actions to protect intellectual property rights and patents.

Strategic Initiatives

Product Development: Continued innovation with new game releases, including Marble Race, a new Fishing game, and Fireball Roulette.

Market Expansion: Ongoing projects for new studios in Brazil and the Philippines, with plans to open 3-4 new studios in 2025.

Regulatory Adaptation: Implementation of technical measures to comply with evolving regulations in various markets.

Operational Challenges

Cyber-Attacks: Persistent issues in Asia affecting video distribution.

Increased Tax Rates: Impact on margins, with an estimated EBITDA margin range of 66-68% for 2025.

Financial Position

Cash Flow: Strong cash flow from operating activities at EUR 1,301.0 million for the year.

Investments: Significant investments in intangible assets (EUR 71.4 million) and property, plant, and equipment (EUR 65.3 million).

Debt-Free: The company remains highly profitable and debt-free, with a strong cash position.

Future Outlook

Growth Focus: Continued investment in growth and market share expansion in the online casino market.

Margin Expectations: Slightly lower EBITDA margins anticipated due to increased costs and regulatory changes.

Innovation and Expansion: Strong product roadmap and strategic studio expansions to support future growth.

Capital Returns: Execution of capital returns to shareholders through dividends and share repurchases.

Recommended Resources

Ali's Notes from Evolution's ICE 2025

FlössösMadrid’s Notes on ICE 2025

Nice summary !