Ticker: $AFL.AX

Price: $0.115 AUD

Shares outstanding fully diluted: 91.3M

Market cap: AUD 10 Million

The Company

AF Legal Group (AFL) is a company that provides legal services to people dealing with personal and family-related legal issues. They specialize in areas like:

Family Law: Helping people with divorces, child custody, and property settlements.

Contested Wills and Estates: Assisting when there are disputes over inheritances or wills.

Criminal Law: Defending individuals accused of crimes.

In simple terms, AFL helps people navigate tough personal situations by giving them legal advice and representing them in court if needed. They also recently expanded by acquiring other law firms to grow their services and reach more clients.

AF Legal faced significant challenges over the past few years, leading to a major shake-up in leadership and strategy. The company’s issues began with overpromising and underdelivering on financial results, creating a credibility gap with investors. Misleading pro-forma projections and missed expectations caused a sharp decline in market confidence. Matters worsened when the former CEO sold a large portion of his shares at a low price, citing "tax reasons," further eroding trust. A proposed merger, which would have heavily diluted shareholders and added unsustainable debt, was met with strong opposition and eventually abandoned amidst internal disputes and governance concerns.

The turning point came with the appointment of Chris McFadden as interim CFO and later CEO. McFadden, known for his success at Ashley Services (ASH:ASX), where he led a 10x transformation, brought a disciplined and strategic approach to AF Legal. Alongside him, Peter Johns joined as Executive Director, representing a substantial shareholder interest. Under their leadership, management costs were significantly reduced, and the company shifted to a leaner, more ethical structure.

Despite the turmoil, AF Legal’s core partnerships and revenue base remained intact, thanks to its capital-light, fast-turn legal model. With a renewed focus on operational efficiency and a more disciplined management team, the company is now positioned to rebuild trust and pursue sustainable growth

The Financials

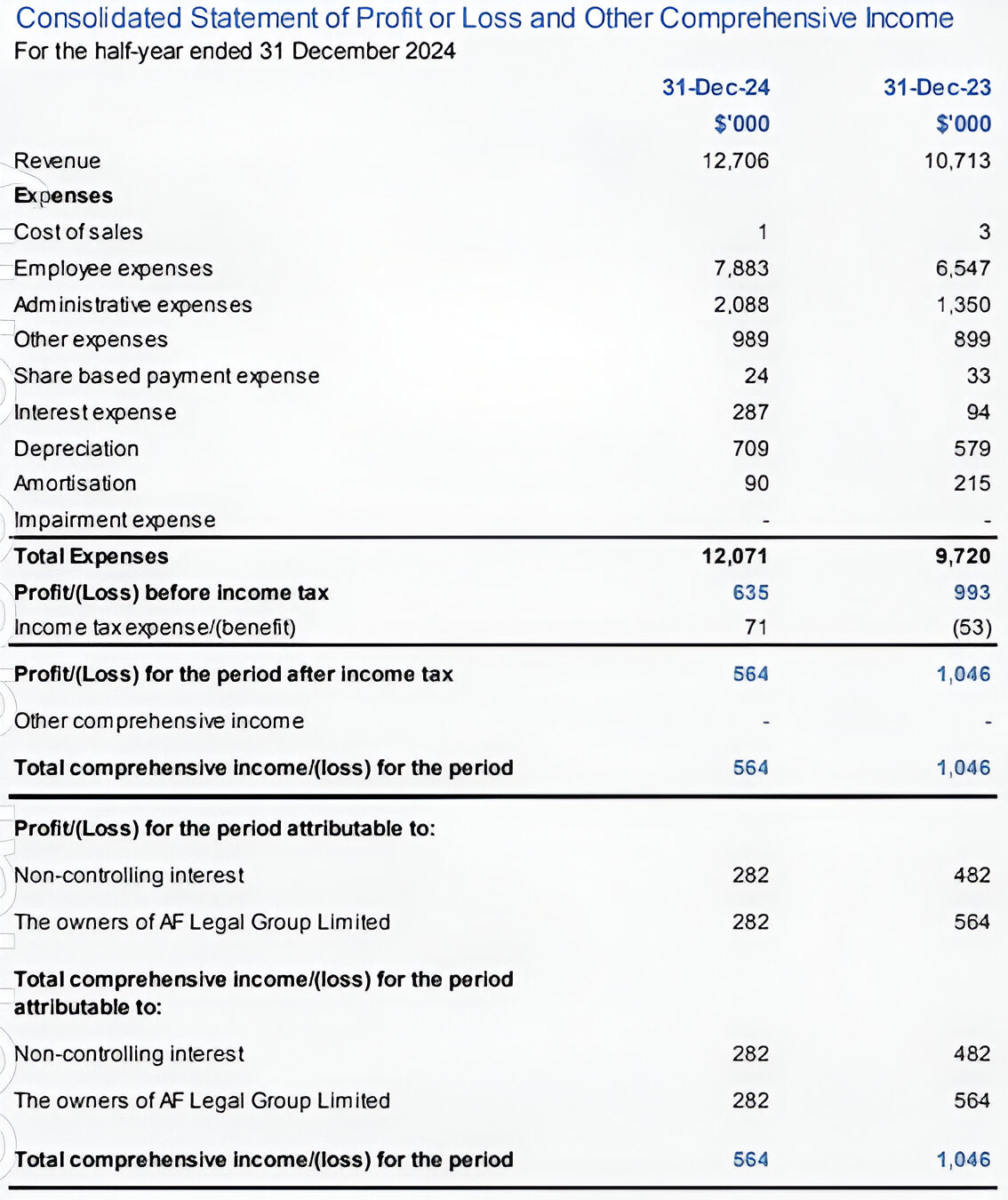

The acquisitions affect both the income and the cash flow statements in several respects, and the picture is distorted considerably. I am using the latest detailed figures from the half-year report.

Income Statement

Profit is best viewed from a normalised point of view, due to one-off restructuring effects as well as acquisitions.

AF Legal Group Limited’s H1 FY25 results reflect a company balancing strong growth with rising costs and legacy challenges. Revenue reached $12.7 million, a 19% increase from the prior corresponding period, driven by the consolidation of ACWE and Armstrong Legal’s Criminal and Family Law, as well as some modest organic growth in the Family Law Business.

Profitability, however, faced pressure. Net Profit Before Tax (NPBT) fell to $635,000 from $993,000 in H1 FY24, primarily due to rising employee and administrative expenses as the company expanded, as well as acquisition costs. Legal defense fees of $310,000, related to two ongoing matters from 2021 and 2022, further weighed on results. These fees, expensed conservatively, reflect the company’s cautious approach, though discussions with insurers about coverage are ongoing. These matters include a litigation case over the recruitment of a senior lawyer approximately three years ago. The case revolves around whether there was a breach of their previous employment terms, and a regulatory investigation which does not involve fraud or financial misconduct but rather procedural issues, such as adherence to professional standards (e.g., lawyer behavior during negotiations). The company is confident in its position based on advice from professional advisors. Overall, these seem like legit one-offs as these issues were factually created by the previous management team and I’m sure the current management will go out of its way to make sure these problems won’t happen again.

Despite these challenges, the underlying business remains strong. Normalized NPBT rose to $1.08 million, up from $993,000, demonstrating resilience when one-off costs are excluded. Normalized NPBT attributable to owners (1) also improved to $561,000, compared to $510,000 in the prior comparable period.

Cash Flow

The financing activities for the period reported a $1.4 million inflow, which was primarily driven by $634,000 in lease liability repayments and $253,000 in dividend payments to non-controlling interests. This inflow reflects the impact of the AASB 16 accounting standard, which reclassifies operating leases as "right-of-use" (ROU) assets and corresponding lease liabilities. Under this standard, lease expenses such as rent are no longer treated as operating costs but are instead shifted to depreciation and interest expenses.

From an economic perspective, however, these lease payments still represent ongoing operational costs, such as rent for office spaces. While adjusting for AASB 16 treatments provides a more real accounting view, it adds unnecessary complexity to the analysis. The cash costs of these leases are actually lower than the accounting treatment suggests, meaning that earnings are understated. This conservative approach is acceptable for a simpler and more straightforward analysis.

For example, in H1 FY25, AFL reported $634,000 in lease liability repayments under financing activities. To better reflect the economic reality of these payments as operational costs, this amount should be subtracted from the reported operating cash flow of $3.0 million. After this adjustment, the operating cash flow is reduced to $2.37 million.

Balance Sheet

I will leave this section without comments for now, as all the relevant information can be found in the latest earnings call and presentation.

Acquisitions

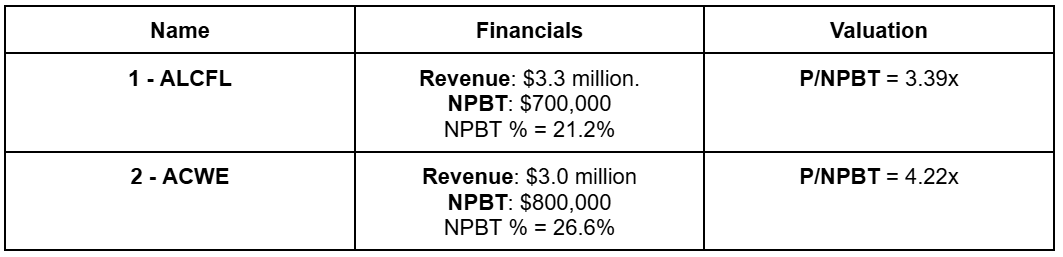

1 - Armstrong Legal’s Criminal and Family Law - AF Legal Group Limited’s acquisition of Armstrong Legal’s Criminal and Family Law practices, along with the armstronglegal.com.au website, is a strategic move to diversify its services and expand nationally. Valued at $2.25–$2.5 million and funded through the NAB Finance Facility, the deal includes client matters, work-in-progress, and staff, with no further earnout payments required.

This acquisition marks AF Legal’s entry into criminal law, complementing its family law and contested wills practices. Notably, criminal law and contested wills are higher-margin areas compared to family law, offering significant profitability potential. Criminal law, currently focused in New South Wales, is set for national expansion, supported by a highly regarded team and a strong cash flow profile from upfront trust payments.

The armstronglegal.com.au website, one of Australia’s most visited legal platforms, is a key asset, generating substantial lead volume across all practice areas. It is expected to drive organic growth beyond New South Wales and further enhance profitability.

2 - Armstrong Contested Will 🙴 Estates (ACWE) - AF Legal Group Limited’s acquisition of Armstrong Contested Wills & Estates (ACWE) represents a strategic expansion into a higher-margin, complementary area of law. The acquisition, valued at $3.0–$3.75 million (including potential earnouts), was funded through a combination of the NAB Finance Facility and a $2.95 million entitlement offer. The deal includes key assets such as client matters, work-in-progress (WIP), debtors, and staff, with built-in protections to ensure 80% of WIP and receivables are collected within two years. It operates on the East Coast, with offices in Sydney, Melbourne, and Brisbane, and is led by a highly regarded team of accredited specialists. Contested wills and estates law is a lucrative area and has high barriers to entry due to the need for significant working capital to support cases that typically take 12–24 months to resolve. AF Legal’s scale and resources position it well to capitalize on this opportunity while leveraging its existing office network for cost efficiencies.

The acquisition is projected to generate $3.0 million in annual revenue and $800,000 in NPBT in FY25, with further upside from synergies and organic growth. The deal also includes five years of access to contested estate leads from the Armstrong Legal and Go To Court websites, ensuring a steady pipeline of new cases.

The reason they were able to acquire these high-margin businesses at such low multiples is tied to the financial struggles of GTC, the previous owner of both ALCFL and ACWE. Around 2.5 years ago, the old management of AF Legal Group attempted to purchase the entire GTC Legal business, which owned Armstrong at the time. However, the deal fell through, and the old management was replaced. The new management maintained good contact with the GTC team. Eventually, GTC, burdened by excessive debt, was forced to sell Armstrong at a distressed price to pay down its liabilities.

Since the new CEO took over in 2023, they spent roughly AUD 5.8M in acquisitions and they funded them with Debt and proceeds from a capital raise in 2024. It’s worth noting that since Chris, the current CEO, took over they have diluted shareholders by 16.85%.

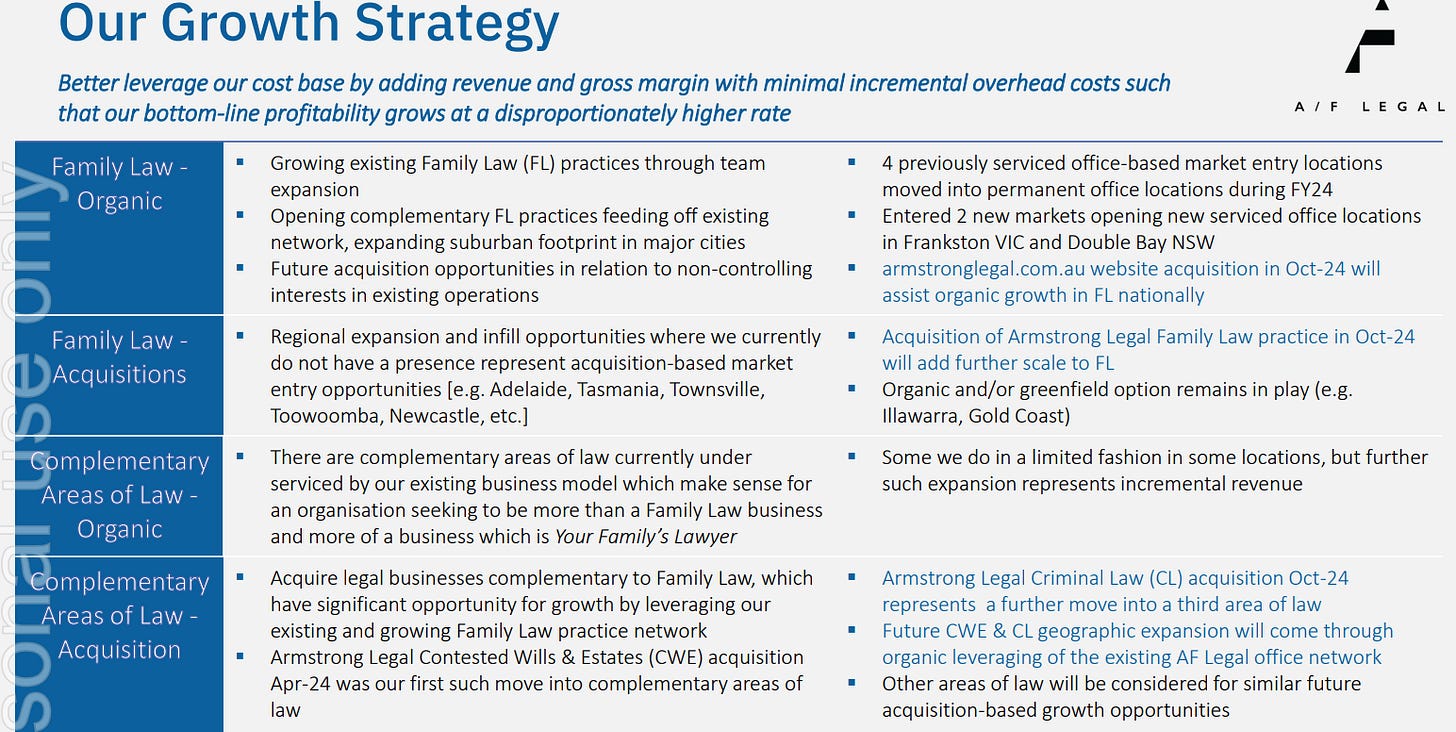

I anticipate that management will continue to grow the family law and related legal services business through acquisitions, in line with their stated growth strategy.

Management & Shareholding

Chris McFaydan - is the current CEO of AF Legal Group (ASX:AFL), a role he took on in July 2023 after serving as the company’s CFO/COO since February 2023 and Interim CFO from November 2022. Since becoming CEO, he has focused on building a "people-first" culture and improving operational efficiency. His total annual compensation is AUD 502,000, which includes salary, bonuses, and stock options.

Before joining AF Legal Group, McFadden played a key role in the turnaround of Ashley Services Group (ASX:ASH), where he served as CFO & Exec Director. During his tenure, he oversaw a significant transformation, including a reported 1,000% increase in the company’s market capitalization over five years. He resigned from Ashley Services Group in June 2022 for personal reasons.

The recent acquisitions and the turnaround at ASH, which was partially driven by acquired growth, suggest that he has good capital allocation skills. It’s worth noting that performance rights and bonuses are tied directly to NPBT per share, therefore dilution will not only hurt shareholders but also his compensation.

Shareholding: 1.83%

Peter Johns, a board director of AF Legal Group (ASX:AFL) and founder of Westferry Investment Group, has a strong track record as both a private investor and a fund manager. Before establishing Westferry, he managed investments through a private company, Three Hundred Capital, which delivered exceptional returns. From 2017 to 2020, Three Hundred Capital achieved a total return of 119.4%, significantly outperforming the ASX200 Total Return Index (+29.5%) and the ASX Small Ordinaries Accumulation Index (+31.3%) over the same period. In 2021, Peter launched the Westferry Fund, which continues to focus on small and micro-cap ASX-listed companies, as well as other niche investment opportunities. Since its inception, the Westferry Fund has delivered a total return of 55.2% and an annual compound return of 11.4%, outperforming the ASX200 Total Return Index (+50.6%) and far exceeding the ASX Small Ordinaries Accumulation Index (+16.6%).

Peter’s investment philosophy emphasizes uncovering undervalued and overlooked opportunities, particularly in less liquid markets where he can gain a competitive edge. It is also worth noting Peter’s background as legal counsel to the Brisbane State Coroner, which complements his role as a director of AFL, and could be valuable now that AFL acquired a criminal law practice.

Shareholding: 14.85%

Valuation & Upside

Since the effects of the AASB 16 accounting standard are minor, I will use the reported NPBT figures for my valuation.

(3) (4)

Base Case

To simplify the valuation, I evaluate AFL’s performance based on calendar years rather than fiscal years. Family law is expected to generate around AUD $20M annually in revenues. AWCE should contribute AUD $3M, and ACF should add AUD $3.3M annually, totaling approximately AUD $26M.

In terms of Net Profit Before Tax (NPBT), family law can achieve a margin of 2.5%, resulting in AUD $500k, nothing too complicated about this. Before the acquisitions, Family Law had profit margins between 2% and 4%. Taking a more normalized 2.5% seems reasonable, and might even be an understatement due to the hiring efforts they are putting on and lower leave hours in H2. AWCE is projected to contribute AUD $800k, and ACF AUD $700k annually, leading to a total NPBT of AUD $2M.

Revenues:

Family Law: AUD $20M

AWCE: AUD $3M

ACF: AUD $3.3M

Total: AUD $26M

NPBT:

Family Law: AUD $500k (2.5% margin)

AWCE: AUD $800k

ACF: AUD $700k

Total: AUD $2M

Conservative Case

Revenue remains the same, but I assume ACF performs slightly worse, contributing AUD $600k in NPBT. Additionally, family law is expected to achieve a 2% NPBT margin instead of 2.5%, assuming that the new hiring doesn’t effectively leverage the fixed costs they have. This results in a total NPBT of AUD $1.8M.

NPBT:

Family Law: 2% margin

ACF: AUD $600k

Total: AUD $1.8M

Bull Case

In this scenario, family law grows by about 4% and achieves a 3% NPBT margin, reflecting the positive improvements from the bigger employee base and lower leave hours, while the other contributions remain the same as in the base case. This results in a total NPBT of AUD $2.1M.

Growth: Family Law grows by 4%

NPBT:

Family Law: 3% margin

Total: AUD $2.1M

Comparables and 3y IRR

Looking at publicly traded comparable businesses:

Shine Justice Ltd (ASX: SHJ) trades at 19.4x LTM P/E.

Slater and Gordon (ASX: SGH) trades at 3.2x LTM P/E.

DWF Group (LSE: DWF) trades at 26.2x LTM P/E.

Gateley (AIM: GTLY) trades at 31x LTM P/E.

Keystone Law Group (AIM: KEYS) trades at 21x LTM P/E.

This gives an average multiple of around 20x. However, I haven’t done a deep dive into these businesses, so factors like growth profile, areas of legal specialization, and geography could mean that 20x may not perfectly reflect AFL’s case.

Using a more conservative 12x multiple as the best-case scenario, and assuming AFL’s margins remain relatively stable. While the exact numbers may vary depending on the inputs, my goal isn’t to achieve precision but to form a directionally accurate view of valuation.

I believe AFL can grow 5% organically per year and 10% through acquisitions annually if they continue their recent trends. For my conservative case in the 3-year model, I assume they fail to grow organically and manage to grow only 5% from acquisitions. In my base case, I assume 5% growth through acquisitions and 5% organic growth. For my bull case, I assume the best-case scenario of 15% total growth per year.

This model is obviously imperfect and likely wrong in some respects, but my aim is to establish a reasonable range of potential returns from this opportunity. With that said, I wouldn’t be surprised if AFL would be worth AUD 0.20 - 0.30 in 3 years, which equates to more than a 100% gain for the base case.

Downside

In my opinion the downside is pretty much capped long term, the business is lumpy throught the year but stable in demand, it resembles the funeral business, since unfortunatelly people will always need help in legal issues and AFL stands on solid divorce rates and just became more robust and diversified but investing in other areas of law.

The lack of a clear catalyst other than better screenability and fundamental improvements might cause the stock to trade sideways for quite a while until the market realizes the full potential of this opportunity.

Why this opportunity exists

AF Legal (ASX:AFL) is trading at a heavily discounted valuation due to a series of past missteps and market distrust. The company’s stock has fallen significantly, driven by overly optimistic pro-forma results that created unrealistic expectations. When the actual FY2022 results missed these projections—falling short on revenue by 16% and Underlying NPATA by 74%—the market responded with a sharp sell-off.

Further damage was caused by poor management decisions, including the former CEO selling 40% of his holdings at a depressed price shortly after the disappointing results, citing "tax reasons." This, combined with a poorly timed buyback program and a proposed merger that would have diluted shareholders by nearly 100%, eroded trust in the company. Internal disputes, leaked emails, and revelations of unreported executive compensation added to the turmoil, culminating in a board spill and the departure of key directors.

Despite these challenges, the company’s partnerships and revenue base have remained intact, and its capital-light business model means it is not burdened by significant cash outflows. The appointment of Peter Johns, a substantial shareholder and experienced fund manager, and Chris McFadden, a seasoned CEO with a history of turnarounds, marks a shift toward better governance and operational discipline. Management wages have been significantly reduced, and the company is now focused on stabilizing its operations.

The current depressed valuation reflects the market’s skepticism, but it also presents an opportunity for investors who believe in the potential for a turnaround. If the new management team can execute effectively and restore confidence, there is significant upside potential.

Conclusion

I think AFL Legal has great potential over the next three years and is worth keeping an eye on. In the short term, the returns might not fully reflect the economic reality of the business, as it could take some time for the financials to become clear on the surface and through screening tools.

NOTES

(1) - For AFL it makes sense to look at NPBT attributable since they have some minorities where not all the profits go to the parent (AFL).

(2) - The repayment of lease liabilities, amounting to $634,000 in H1 FY25, represents cash outflows related to the company’s lease agreements. Under accounting standards (AASB 16/IFRS 16), lease liabilities are recorded on the balance sheet for long-term leases, and repayments are treated as financing cash flows rather than operating expenses. This means that while these payments reduce the company’s financing cash flow, they do not directly impact operating cash flow.

In this case, if the repayment of lease liabilities were excluded from the financing cash flow calculation, the net cash inflow for H1 FY25 would increase from $1.0 million to $2.4 million. This adjustment provides a clearer picture of the company’s underlying cash generation, as lease repayments are more of a structural financial obligation rather than a reflection of operational performance.

(3) - Used 25% tax rate [updated this on the 09/03 at 21:00 Lisbon time because

and Winter Capital gently corrected my mistake of using P/EBT](4) - A user named

on Substack pointed out a significant mistake in my valuation. I mistakenly assumed that all the revenues and profits from the ACF acquisition would be counted in FY 25, which isn't correct. I also made some other errors. To avoid misleading readers, I deleted the comments, especially since Claude was a bit too aggressive, even though I didn't mean to mislead anyone. But the world is full of good intentions and I did the mistake so I don’t blame him at all.Check out

’s work on $AFL.AX he has been watching for years now.

Thanks for the nice write up!

I think you should at least try to calculate EV. In my calculation I did split Cash and other relevant Assets and Liabilities by NPBT attributable to AFL as a percantage of NPBT and subtracted the whole debt related to M&A.

By doing so you come to a more conservative upside.

Normalized NPBT attributable to owners in H1 FY 2025 was $561,000, so your "base case" is for Normalized NPBT attributable to owners to jump 179% half on half to $1.57m?